Zacks Analysts Expect Pepsico Inc Pep Will Post Quarterly Sales Of 15 66 Billion

As PepsiCo Inc. (PEP) approaches its much-anticipated quarterly earnings report, analysts from Zacks Investment Research have set expectations at a commendable $15.66 billion in sales. This figure encapsulates the company’s robust market position amidst fluctuating economic conditions and ever-changing consumer behaviors. Understanding the intricacies behind these projections requires delving deeper into the factors propelling PepsiCo's revenues, the market dynamics at play, and how the brand remains a titan in the beverage and snack industry.

PepsiCo has consistently demonstrated a remarkable ability to adapt to market shifts. This adaptability stems from its diverse product portfolio, which includes iconic beverages and snack foods like Lay’s chips, Gatorade, and Tropicana juices. In a world where consumer preferences are rapidly evolving—favoring healthier options and sustainable practices—PepsiCo has committed to innovation, continuously launching new products that respond to these trends. For example, its line of zero-sugar beverages and healthier snack alternatives reflects an acute awareness of health-conscious consumer demands.

Moreover, PepsiCo's international presence further amplifies its sales potential. The company operates in over 200 countries, allowing it to mitigate risks associated with economic downturns in specific regions. For instance, while North America remains a significant contributor to sales, emerging markets in Asia and Latin America are experiencing burgeoning growth. These regions exhibit a rising middle class eager for branded products, thus presenting PepsiCo with ample opportunities to bolster its bottom line.

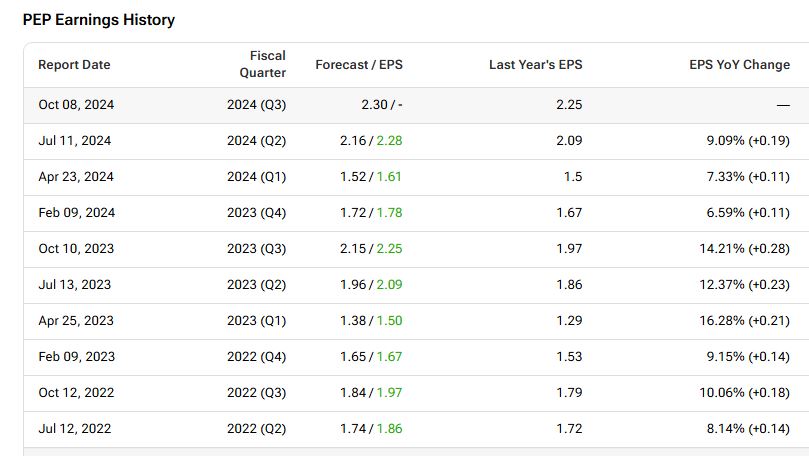

To comprehend the significance of the $15.66 billion figure, one must consider the historical context of PepsiCo's earnings reports. In Q3 of the previous fiscal year, the company delivered stellar results that surpassed analysts' expectations. Its ability to generate robust sales growth even during challenging times has solidified investor confidence. By maintaining an annual growth rate of around 6% over the past five years, PepsiCo demonstrates resilience and operational excellence. The forthcoming earnings announcement is therefore not just a financial event; it is a critical juncture that will provide insights into the company's ongoing strategies and market positioning.

The pricing strategy employed by PepsiCo also merits discussion. Price elasticity plays a crucial role in determining how consumers respond to price changes. Given the company's extensive brands, some of which are perceived as household staples, PepsiCo has some leverage to pass on cost increases to consumers without significantly impacting demand. This is especially relevant in the context of inflationary pressures affecting various commodities and ingredients. As prices fluctuate, consumers may still gravitate towards established brands that offer reliability and quality, which, in turn, could sustain PepsiCo's sales trajectory.

Part of the reason behind the bullish outlook for the upcoming quarter is the impressive performance attributed to the company’s recent marketing strategies. PepsiCo has effectively utilized digital platforms and innovative marketing campaigns to engage with younger demographics. Collaborations with popular social media influencers and strategic partnerships—such as those with sporting events or music festivals—have enhanced brand visibility and resonance with target audiences. These efforts translate into increased customer loyalty and encourage repeat purchases.

Additionally, the company’s supply chain resilience has proven pivotal as it navigates disruptions from global events, such as the COVID-19 pandemic and geopolitical tensions. Investments in technology and logistics have allowed PepsiCo to maintain product availability and respond promptly to consumer demand fluctuations. This operational agility is crucial, particularly as consumers become accustomed to seamless shopping experiences both online and offline. A robust supply chain not only ensures that products reach consumers but also helps maintain the necessary inventory levels to capitalize on sales opportunities.

It is also essential to consider the broader economic environment when discussing PepsiCo's expected sales. With interest rates fluctuating and inflationary pressures affecting disposable incomes, consumer spending behaviors can vary significantly. Nevertheless, PepsiCo's diverse product range allows it to cater to a wide array of price points and preferences. This variety mitigates the risk of a downturn in any specific category, thus aiding in maintaining sales momentum.

Investors will undoubtedly be attentive to PepsiCo's guidance for the remainder of the fiscal year. Given the company's historical consistency in driving sales growth, the anticipation surrounding the $15.66 billion projection reflects a collective optimism based on sound financial practices and strategic foresight. It’s an expectation underscored by the company’s adeptness at adapting to market challenges and seizing opportunities for growth.

As we approach the earnings report, it becomes increasingly clear that PepsiCo is not merely riding the waves of market trends but is actively shaping them. The effective intermingling of tradition and innovation within its business strategy sets a formidable precedent in the food and beverage sector. Investors and analysts alike will be keen to see how the company addresses market challenges, capitalizes on growth opportunities, and continues to drive forward in its quest for sustained success.

Ultimately, the upcoming quarterly report is more than just numbers; it is a harbinger of PepsiCo's future trajectory in a complex and competitive landscape. The confluence of innovation, market adaptability, and robust supply chain management positions PepsiCo favorably as it approaches this pivotal moment. The anticipated $15.66 billion in sales not only serves as a testament to the company's strategic prowess but also lays the groundwork for future ambitions in a rapidly evolving market environment.

Post a Comment