Kerry Group Plc Kryay Upgraded At Zacks Investment Research

In the intricate world of financial markets, the evaluations and perceptions of investment analysts can significantly sway stock prices and investor confidence. Recently, notable investment research firm Zacks Investment Research elevated its rating of Kerry Group Plc (OTCMKTS: KRYAY) from a “Hold” to a “Buy.” This pivotal upgrade has prompted investors and market analysts alike to recalibrate their expectations regarding the company’s future performance and growth trajectory.

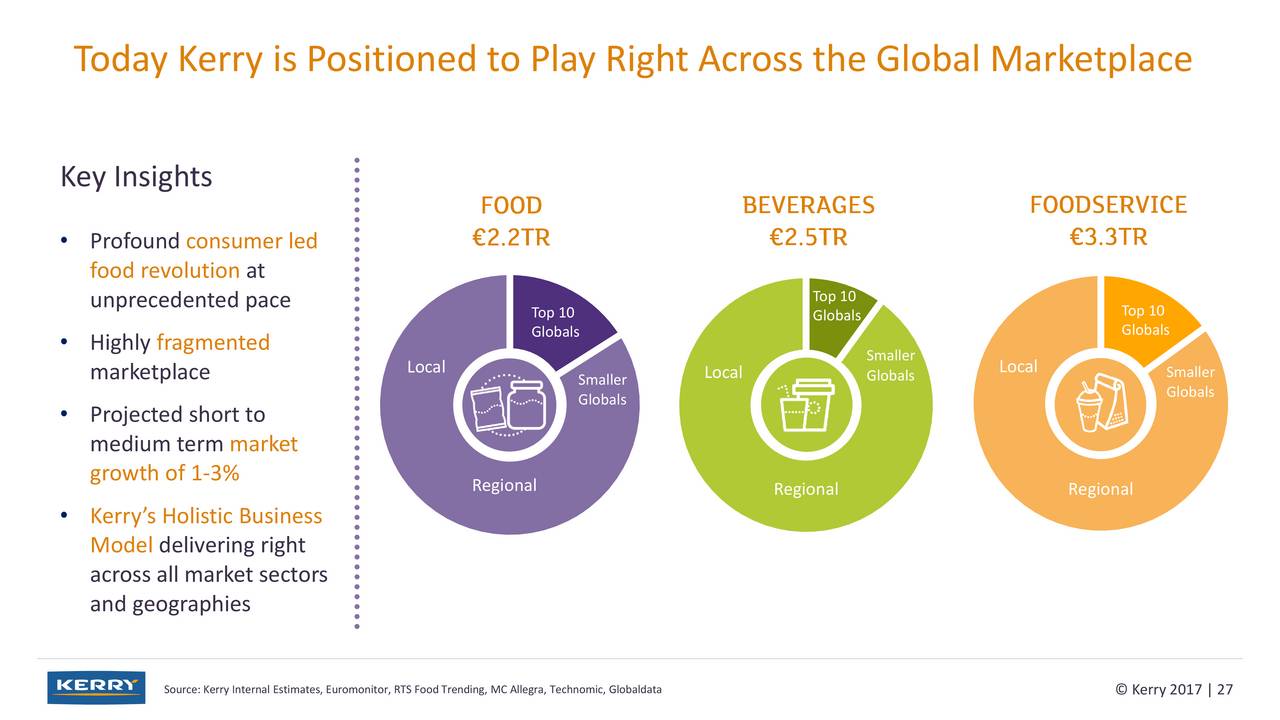

Kerry Group, an Irish-based global leader in taste and nutrition solutions, has established itself as an indispensable player in the food and beverage sector. The firm specializes in creating innovative ingredients and solutions for its customers, ranging from large multinational corporations to local artisan producers. The recent upgrade by Zacks reflects an optimistic outlook regarding the company’s operational efficiencies, market positioning, and potential for continued growth in an evolving industry landscape.

As global demand for healthier and more sustainable food options escalates, Kerry Group stands poised to capitalize on these emerging consumer trends. The company’s robust portfolio of products comprises various segments, including meat substitutes and plant-based solutions, which cater to a rapidly expanding market demographic increasingly wary of traditional meat consumption due to health, ethical, and environmental considerations.

The meticulous upgrade from Zacks emanates from a confluence of factors. First, Kerry Group’s financial performance has consistently outpaced expectations. The most recent quarterly reports indicate a healthy increase in revenue and a noticeable enhancement in profit margins, a testament to the company's refined cost-control measures and efficient operational protocols. Such financial robustness is particularly impressive in a market riddled with volatility and uncertainty, underscoring the firm’s capable management and strategic vision.

Moreover, the company has been at the forefront of innovation, consistently investing in research and development (R&D) to maintain its competitive edge. The introduction of new product lines, particularly in the realm of plant-based foods, resonates with contemporary dietary trends favoring sustainability. Kerry's strategic emphasis on R&D has not only fortified its market position but also markedly enhanced consumer engagement, as customers increasingly seek brands that align with their values.

In assessing the broader implications of Zacks' upgrade, it is essential to consider the dynamics of the food and beverage market. As global populations burgeon and consumers become more discerning, firms like Kerry Group are compelled to adapt swiftly to meet changing preferences. The rising tide of health-consciousness necessitates that food producers innovate continually, and Kerry's commitment to this endeavor has rendered it a bellwether in the industry.

Furthermore, the company's strategic alliances, particularly with key players in the retail space, have augmented its distribution capabilities and market reach. By partnering with prominent grocery chains and food service establishments, Kerry has bolstered its visibility and sales potentials. These collaborations are crucial as they allow for sharing resources and insights that can propel product development and marketing strategies, ensuring the company stays ahead of its competitors.

However, as with any investment, potential stakeholders must remain vigilant. While the Zacks upgrade heralds a bullish sentiment, several challenges persist. The food industry is notorious for its sensitivity to raw material prices and supply chain disruptions. Recent geopolitical tensions and climate change factors have forced many companies to reassess their procurement strategies, a scenario that can feasibly affect profitability. Kerry Group must navigate these challenges adeptly to maintain its positive trajectory.

It is also essential to scrutinize the regulatory landscape, as changes in food safety laws and regulations, particularly regarding health claims and labeling, can significantly influence market operations. Kerry has historically demonstrated an ability to adapt to regulatory changes, but the persistent evolution of laws necessitates ongoing vigilance and adaptability to ensure compliance and sustain consumer trust.

In conclusion, the recent upgrade by Zacks Investment Research represents a significant endorsement of Kerry Group’s robust business model and forward-thinking strategies. As the company continues to drive innovation in a sector increasingly defined by health and sustainability, investors are likely to take encouragement from the firm’s prospects for growth. With its favorable financial metrics, commitment to R&D, and strategic market positioning, Kerry Group is charting a promising path in the competitive world of food and beverage production.

The upgrade serves as a reminder of the dynamic nature of the market; it underscores how analytical insights and market realities can coalesce to influence corporate trajectories. As stakeholders closely monitor Kerry Group’s performance in the months to come, its adaptability and innovation will undoubtedly remain at the forefront of discussions, shaping the narrative around its enduring status as a market leader.

Post a Comment