Core Mark Holding Co Core Plans Dividend Increase 0 09 Per Share

Core-Mark Holding Company, Inc., a prominent player in the distribution of fresh and packaged goods, has made headlines with its recently announced plans regarding a dividend increase. Investors are often keenly interested in such developments as they reflect a company’s financial health and operational efficacy. The proposed increase of $0.09 per share not only marks a significant step for Core-Mark but also underscores its commitment to delivering shareholder value in an increasingly competitive landscape.

Founded in 1888, Core-Mark has carved a niche in the distribution business by aligning its operations with the needs of convenience stores and other retailers. This focus has enabled the company to build a vast portfolio that underscores its expertise in supply chain management. The planned dividend increase is emblematic of its robust operational strategy and confidence in future earnings growth. As the company navigates the intricacies of the marketplace, this decision serves as a message to investors about sustainable profitability.

Dividend increases are not just a matter of financial mechanics; they are crucial signals of a company's performance and outlook. A $0.09 per share increase can appear modest at first glance, but its implications are profound. It showcases the organization’s ability to generate consistent cash flows even in a sector rife with volatility. A reliable dividend can enhance the attractiveness of a stock, particularly for income-focused investors. Over time, these increments can compound, enriching shareholders’ returns and potentially inflating the stock’s market value.

The rationale behind a dividend increase often ties back to a company’s strategic moves in its core operations. For Core-Mark, this increase reflects its solid revenue trajectory, even against the backdrop of various economic challenges. As consumer purchasing behavior continues to shift, particularly in the wake of a pandemic that has altered shopping habits, companies that adapt swiftly tend to outperform their competitors. Core-Mark's proactive approach to evolving market dynamics has bolstered its earnings, enabling it to reward its shareholders even in uncertain times.

Additionally, it is worth considering the broader landscape of the food distribution industry. With supply chain disruptions caused by unprecedented global events, businesses have had to exercise greater agility. Core-Mark’s management appears resolute in addressing these challenges head-on. Enhanced distribution mechanisms and logistic efficiencies have combined to create a resilient operating model. Financial fortitude allows the company not only to withstand incredible pressures but also to emerge ready to take advantage of new opportunities.

Furthermore, Core-Mark’s strategic initiatives over the past few years have been pivotal in its growth narrative. The company has embraced technological advancements, utilizing analytics to optimize operations. These tools allow for better inventory management, demand forecasting, and service excellence. Such operational innovations translate into cost savings, ultimately contributing to the bottom line. The capacity to see dividends rise is not merely a function of profit but indicative of smart, data-driven management.

When examining the implications of the dividend increase, it is essential to engage in comparative analysis. Many investors consider a company’s dividend yield relative to its peers. In this case, Core-Mark’s proposed increase still places it competitively within its sector. The food distribution market has seen various players adjusting their dividend policies, often re-evaluating their commitments based on fluctuating profits. Core-Mark’s ability to increase dividends at this juncture positions it favorably among industry rivals.

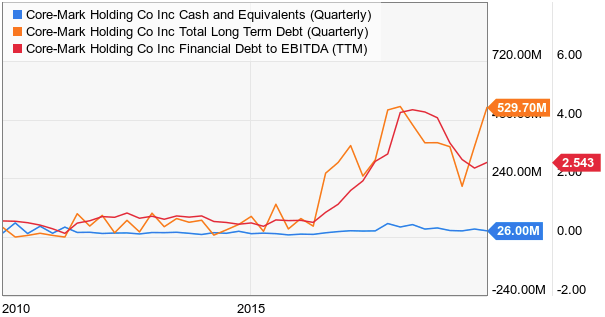

Moreover, a $0.09 increase must be understood within the context of Core-Mark’s broader financial strategy. In times of economic uncertainty, some companies prioritize building cash reserves over paying dividends, a tactic that can protect against downturns. Conversely, Core-Mark's decision may imply its confidence in retaining adequate cash flows while pursuing opportunities for reinvestment. A balanced approach that accommodates both shareholder payouts and strategic growth investments typically indicates prudence in financial stewardship.

Investor sentiment is another critical factor to consider. The announcement of a dividend increase often garners positive reactions from the market, driving stock prices up as investors react enthusiastically to the news. The perception of stability is reinforced; therefore, Core-Mark can expect heightened interest from institutional and retail investors alike. The company’s decision to enhance its dividend is dual-faceted: it serves to attract investment while simultaneously rewarding current shareholders.

In evaluating the future trajectory of Core-Mark and its dividend policy, one must also focus on the company’s ongoing initiatives aimed at sustainability and corporate responsibility. Given the increasing demographic and consumer focus on sustainable practices, Core-Mark is likely positioning itself for long-term viability. Aligning its operations with environmental expectations can not only enhance its public image but also potentially yield long-term financial benefits.

In conclusion, Core-Mark Holding Company, Inc.'s announcement of a $0.09 per share dividend increase is a significant indicator of its financial health and future prospects. Such decisions rarely occur in isolation; they reflect a company’s broader operational effectiveness and strategic foresight. As the food distribution industry continues to evolve amidst changing consumer landscapes, Core-Mark seems poised not only to adapt but also to thrive, all while rewarding its shareholders. Investors can take solace in this increase as an affirmation of the company’s resilience and commitment to maintaining a competitive edge in its sector. With a robust (and growing) dividend policy, Core-Mark sets a positive precedent for its future while reinforcing its foundational principles of value creation and stakeholder satisfaction.

Post a Comment